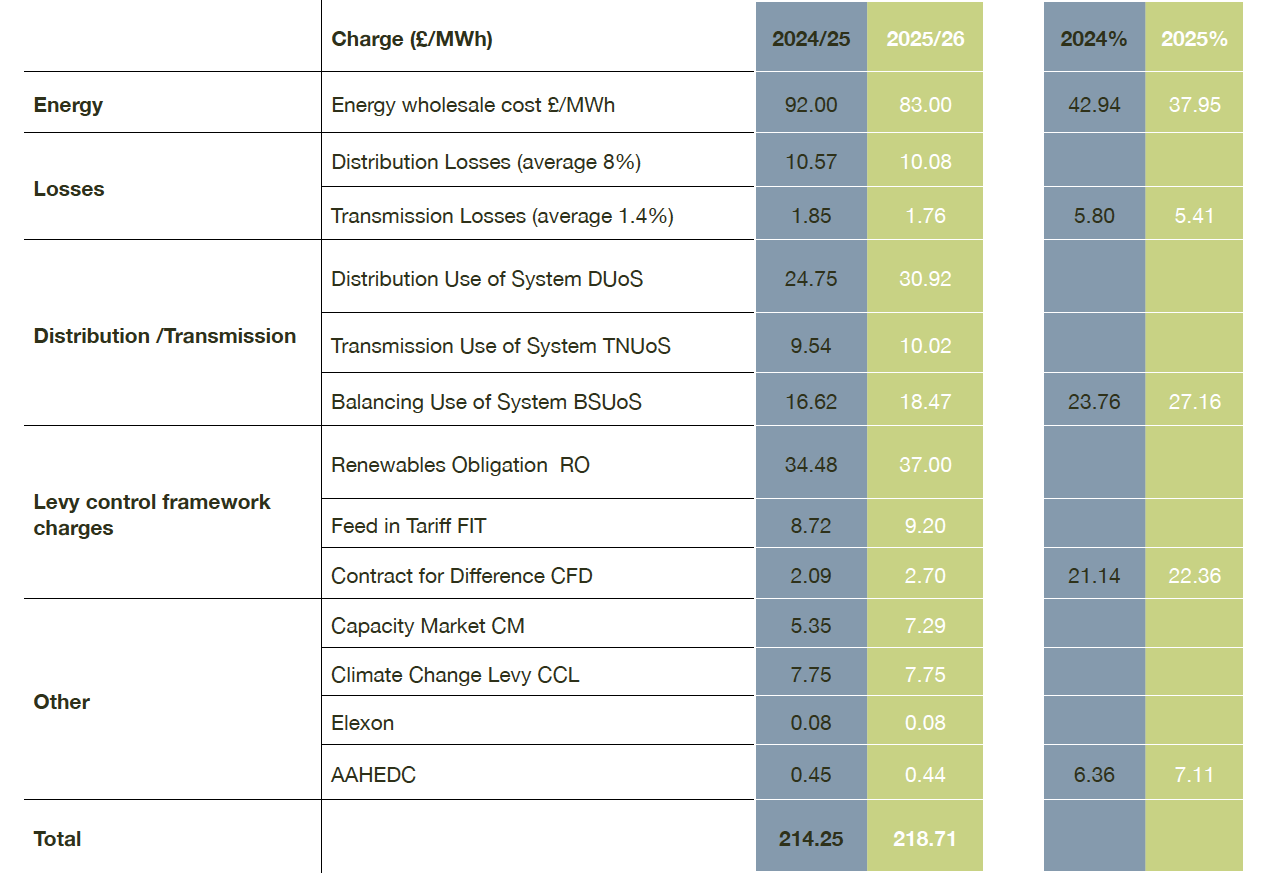

Electricity Import Agreements

For those with supply contracts coming up for renewal in 2025, please see the non-commodity charges table below:

New Stream Renewables Cost Breakdown

The chart shows indicative portfolio average prices based on New Stream Renewables’ internal models.

DUoS and TNUoS can vary significantly and are very site-specific.

PPA and Green Gas Markets Stronger on Geo-Political Risks

- European gas prices hit year-to-date highs in early August, with growing supply concerns offsetting comfortable storage levels.

- Gas continues to support power and PPA pricing but has so far lagged the move.

- Supply risks pushed prices to the highest since December earlier in August.

- This price signal helped divert more liquefied natural gas to Europe.

- Weak industrial demand and comfortable gas inventories have helped to ease some market jitters.

Commentary

Charlie Ward, Head of Renewables at New Stream“We have found some short-term price support as we move through summer. I don’t need to go into any detail on geopolitics as we all know that two wars are playing out in locations that are key for global energy supplies.

We are currently trying to weigh supply risks on the gas side with relatively healthy storage and a continued weak demand outlook.

Gas storage looks comfortable, although inventories are slightly lower than last year. Norwegian pipeline flows have dipped a bit due to unplanned outages at the Gullfaks field just before the usual period of planned maintenance, which will reduce flows further from that sector. Remember, they are Europe’s biggest gas provider.

On the Russian side, gas transit through pipelines crossing Ukraine looked normal this week (Monday 19th August), even with everything going on in the Kursk region with an ongoing military incursion into the Russian territory near a critical gas transit point.”

Front End Gas Pricing

- Dutch front-month futures, Europe’s gas benchmark, were quoted at €39.70 per Megawatt-hour.

The September NBP gas contract in the UK traded around 90p to 95p per therm.

Opportunity for PPA Generators and Green Gas Producers?

Jamie Banks

PPA Manager at New Stream“It’s been a great summer for our PPA clients waiting for an excellent opportunity to fix contracts.

I know it’s been a relief for some clients patiently waiting for market strength to sell into. With pricing continuing to find some support for those generators looking for budget certainty and downside price protection, we still advocate looking at forward PPA fixes.

We appreciate that some will still want to take the price risk on and wait further, but for others, a fixing strategy will better suit business and risk management approach and any debt financing constraints.”

Supply and demand fundamentals look well balanced.

Have geopolitical risks already been fully priced?

Forward markets still hold some risk premium above the spot.

Opportunities for PPA and Green Gas fixing further out along the price curve.

2025 and 2026 above spot markets.

Green Gas Prices Surge as Ukraine Seizes Key Russian Route to Europe

- Europe “remains the largest customer of Russian gas,” warned a cross-party alliance of members of the European Parliament (MEPs) back in March.

- MEPs had been urging for a ban on all Russian energy commodities.

- The situation observed at the time remains unchanged today.

- Long-term contracts and landlocked countries dependent on pipelines to the East.

- There are also no general restrictions on LNG cargoes (please see our commentary on Russian LNG).

Fran Reay

Analyst“We have been closely monitoring Russian pipeline flow data after Ukraine seized the Sudzha gas transit station in the Kursk region.

This became a key point for European transit gas after the Sokhranivka entry point for Russian gas transit via Ukraine was closed; Gazprom had to divert all the gas to the Sudzha entry point.

This all happened in the second week of August, and gas prices in Europe hit their highest level for the year.”

European Gas Storage

- Slower EU storage build forces Dutch TTF gas price revision.

- Strong Asian LNG demand has ensured that JKM (benchmark Asian pricing index) has traded at a healthy premium to TTF for much of 2024.

- July LNG import volumes are down 25% YoY.

- This is the lowest monthly volume since the Russia / Ukraine war started.

- Due to these lower LNG flows, overall gas import volumes into the EU are down more than 7% year on year

Fran Reay

Analyst” European gas prices have hit year-to-date highs in early August, with growing supply concerns offsetting comfortable storage levels in Europe. EU storage is more than 87% full, above the 5-year average of 78%.

However, given what we have seen in the LNG market, those lower imports mean storage builds are slower year over year.

That’s got a few eyebrows raised.”

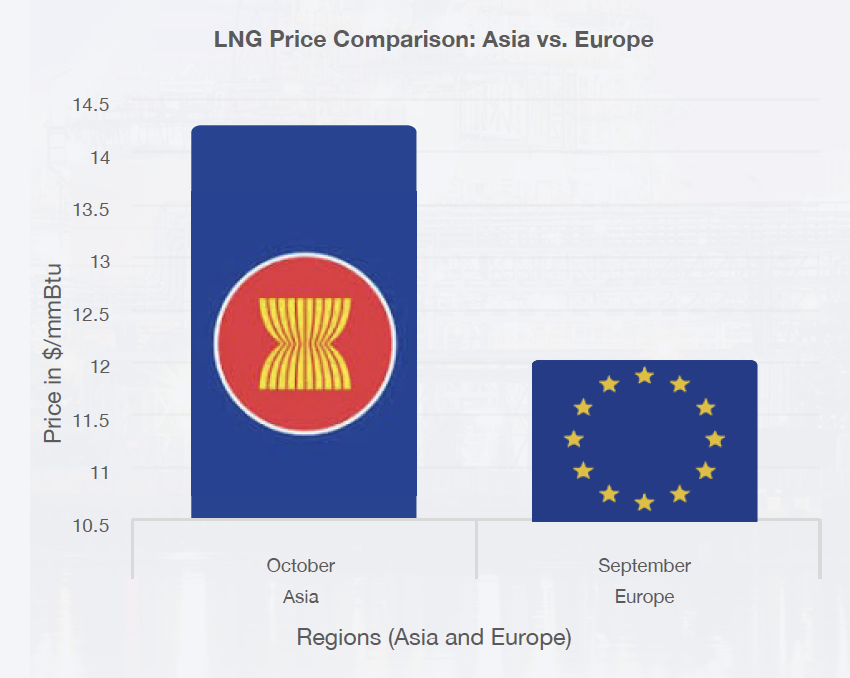

Heat Drives Asian LNG Spot Price

- Asian spot liquefied natural gas (LNG) prices rose to their highest in over eight months.

- Warmer temperatures across the region have been boosting power demand for cooling purposes.

- The continued hot weather forecast is for much of Asia.

- Peak power demand in South Korea early in August nearly topped a record in late July.

- Asia is expected to be the dominant driver in global gas demand growth this year.

- We expect this trend to continue in the years ahead as economies in the region transition towards cleaner fuels.

- EU Gas and Power demand is still struggling.

- Demand in the first half of the year is down nearly 4%.

- There needs to be more signs of industrial and commercial demand returning.

- The average LNG price for October delivery into Asia was $14.25 per million British thermal units (mmBtu).

- In Europe, the North West Europe LNG Index, the price benchmark for cargo delivered in September, was at $12 /mmBtu

Current Market Fundamentals

Current Market Fundamentals

- NBP gas is still the key driver of UK power and PPA pricing.

- Geopolitical Risk on the supply side.

- LNG markets in Asia are suddenly becoming essential for the European energy complex.

- Comfortable Gas Storage position.

- Strong Norwegian pipeline flows despite the summer maintenance season.

- Weak demand outlook.

- Renewable (wind) performance key is setting

- “spot and “system pricing”.

- Continued strong renewable output.

Have green gas prices run out of momentum after recent moves higher?

- Natural gas prices at the NBP and Dutch TTF markets struggle to move higher after the July and early August rally.

- Are geo-political risks now primarily priced in?

- Will headline-driven moves continue?

- Has recent high pricing attracted LNG diversions to UK import terminals?

Will gas storage inventories start to weigh down on a well-supplied market

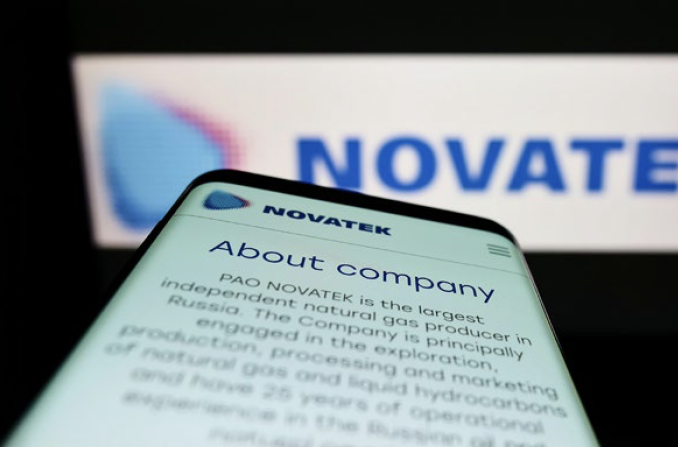

Novatek Set to Dock Second LNG Unit at Sanctioned Arctic Plant

Novatek Set to Dock Second LNG Unit at Sanctioned Arctic Plant

- Despite Western energy sanctions, Russian gas producer Novatek is pushing ahead with an expansion project at its Arctic LNG 2 plant.

- Arctic LNG 2 is part of Russia’s expansion strategy in liquefied natural gas.

- Novatek has delivered a new structure to expand the capacity of the facility.

- Delivery took place from the company’s engineering facility in Murmansk to the Arctic LNG 2 project site on the Gydan peninsula.

- The US sanctioned the facility last year, aiming to cut the energy revenues to the Kremlin.

US Adds Most Power Generation in 21 Years as AI Demand Surges

Commentary

Charles Ward

Head of Renewables

- Capacity increased by most since 2003 in the first half of 2024.

- Solar power leads to planned additions that are seen to double by year-end.

- Electricity generation rose by 20.2 gigawatts between January and June

“It will be interesting to see if the surge in power demand from Data Centers and drive toward electrification will increase demand in the UK as quickly as we have seen in the US market

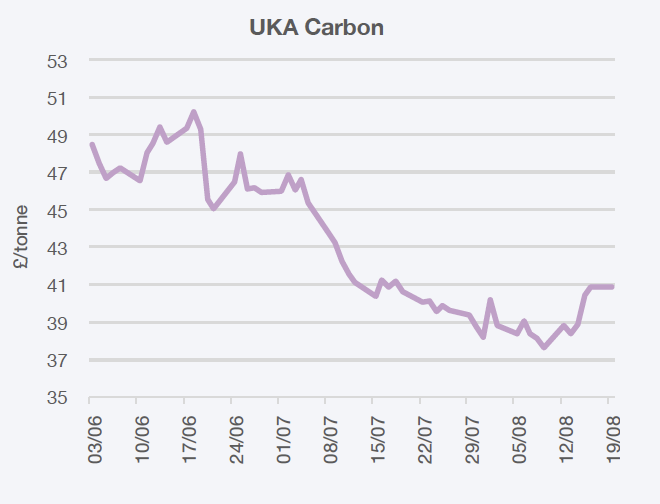

Carbon Markets

- Labour is exploring how to realign the UK’s carbon regime with the EU.

- British exporters have warned that they could pay hundreds of millions of pounds extra in the future because the UK’s carbon price is lower than the EU’s under their respective ETS schemes.

- This is designed to prevent UK or EU-based manufacturers from being undercut by global rivals.

If you want to receive our weekly Whatsapp PPA / GPA price broadcast, please email fran@newstreamrenewables.com