Concerns around Russian gas supplies give strong end-of-year support to UK power and gas.

Review of 2024 by Tom Matthews

In 2024, the UK continued to hit record wind generation, and for the first time achieved a total phase-out of coal. Gas remained the marginal generation source, averaging 30% of the generation mix throughout the year, continuing to drive power prices.

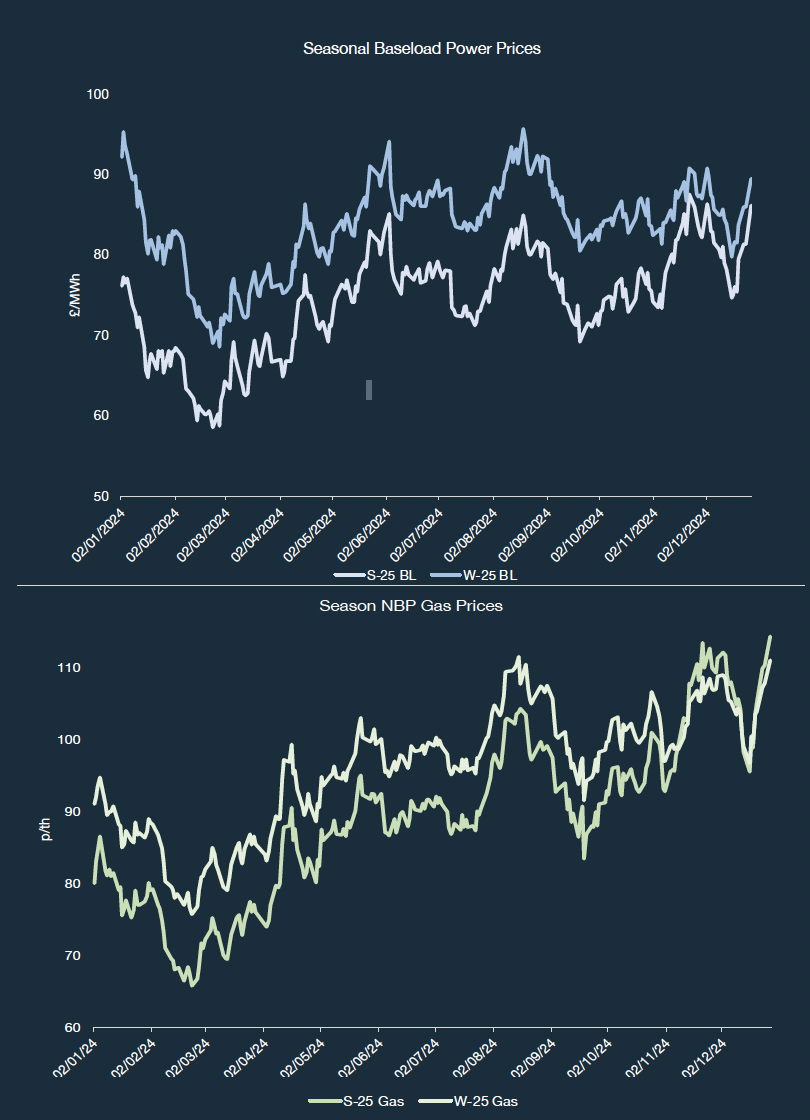

Power and gas prices fell during January and February due to warmer-than-expected weather, healthy European gas stocks, and strong renewable output. Win24 BL lost nearly 30% of its value during this period, hitting its yearlong low of £67.5/MWh. At the end of February, support came from maintenance issues across the continental shelf and concerns around LNG deliveries.

Win 24 and Win25 BL Prices

The bullish trend continued until the start of June, when Win24 and Win25 BL prices reached almost £100/MWh. Prices then eased as maintenance ended, and confidence around EU storage levels increased.

Prices traded in a range for most of 2024, with seasonal winter BL contracts testing the £100/MWh level again during the summer. Concern about the LNG supply was the primary source of strong volatility in summer.

Price support steadily grew towards the end of the year based on concerns that the Russia-Ukraine gas transit agreement—accounting for around 5% of EU gas—would not be renewed. As the 31st December deadline approached, prices rose significantly, with supplies tight enough that losing this volume would substantially impact Europe.

The Sum25 NBP gas contract finished trading for the year at around 115p/th, the highest price seen on this contract in 2024, reflecting a 30% increase across the year. Carbon prices broadly followed movements in the gas market, opening weak but increasing through the summer, further influencing power prices.

Further out on the curve, price movements were more subdued. W26 BL closed the year at around £80/MWh, reflecting the expectation of improved supply conditions.

Tom Matthews

Head of Sustainability

We are pleased to welcome Tom Matthews as the newest New Stream Renewables team member, joining as Head of Sustainability.

Tom has worked in the energy sector for nearly a decade and a half. He brings a wealth of experience helping generators and corporate clients manage their exposure to wholesale power markets while ensuring they meet their decarbonisation goals.

Primarily working in the utility sector, Tom has extensive expertise in wholesale power markets, risk management, renewable technologies, contract negotiation, energy policy, hydrogen, green gas, and product innovation

UK electricity cleanest ever in 2024

- Fossil-fuel power generation sank to its lowest level since 1955.

- Britain’s electricity supplies were the greenest and cleanest in history through 2024.

- The last coal power station, at Ratcliffe on- Soar in Nottinghamshire, closed in October, ending 142 years of coal power in Britain.

- Falling demand and the rise of renewables pushed fossil fuels to around 30%.

- Renewable power supply climbed to a record 45%.

- Nuclear energy accounted for another 13% of the total during the year, with the rest coming from other sources and growing interconnector imports from Europe.

However, gas power stations (CCGTs) remained the top electricity source for the year.

Price Volatility Returns to PPA and Green Gas Market

- UK and Europe Set for Coldest Weather in Years.

- Gas Storage Inventories Deplete.

- Heating Demand to Soar During Cold Snap.

- As far south as Madrid, temperatures are forecast to be the lowest in four years.

- The UK’s coldest winter night was recorded in Loch Glascarnoch, Scotland, earlier this week (-13.3°C)

Fran Reay

Analyst“Finally, we are seeing a bit of cold this winter season. If you look at some of the major European cities, they are bracing for the coldest weather in four years, putting further pressure on gas inventories as heating demand increases.” “It’s incredible to think of Madrid, where temperatures are expected to reach -7°C. That’s the lowest since 2021.”

Fran Reay, Energy Analyst at New Stream Renewables

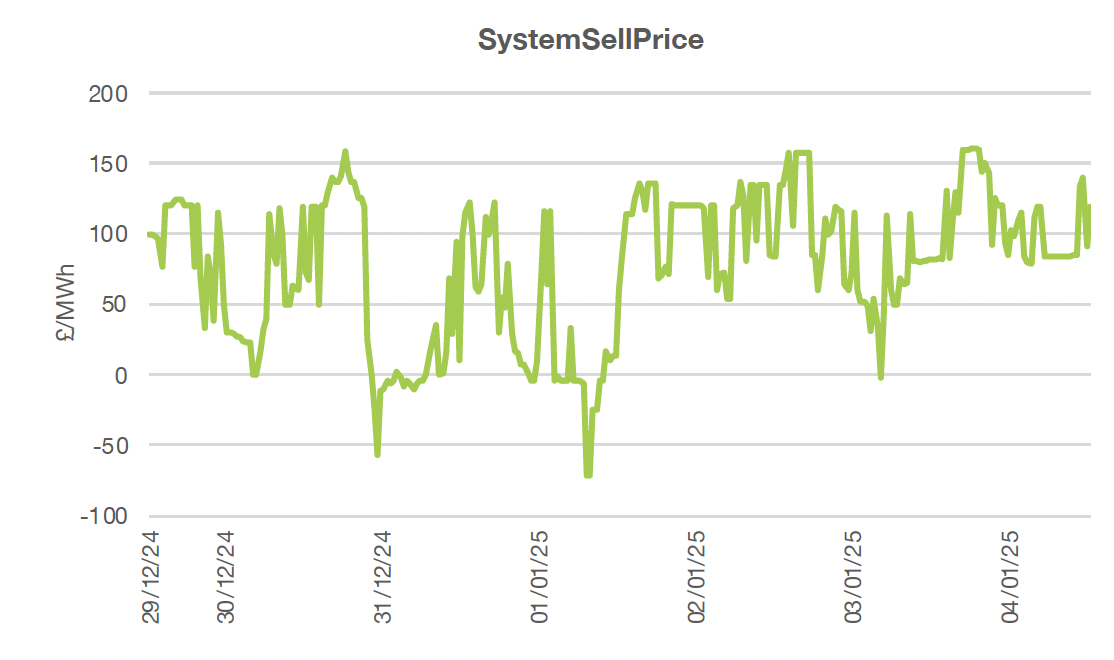

“The demand-side drivers come just days after Russian transit gas flows via Ukraine were halted. Price volatility across PPA and Green Gas Markets is firmly back in play. We have observed significant intra-day price swings exceeding 5%, making fixing timing more important than ever.

With power continuing to lag, the gas move higher and wind performance causing negative power pricing on the spot market, we strongly favour selling into current market strength for PPAs through to 2027. The Green Gas market is slightly less obvious, and we remain cautiously bullish on the underlying TTF and NBP markets.

The Christmas period allowed some of our Green Gas generator clients to lock in some forward seasons against a debt curve or internal budget target. Again, we favour layering any gas hedges due to the market’s volatility. Overall, this market represents a great value opportunity for PPAs and GPAs when you look at relative historical levels.

Charlie Ward, Head of Renewables at New Strea

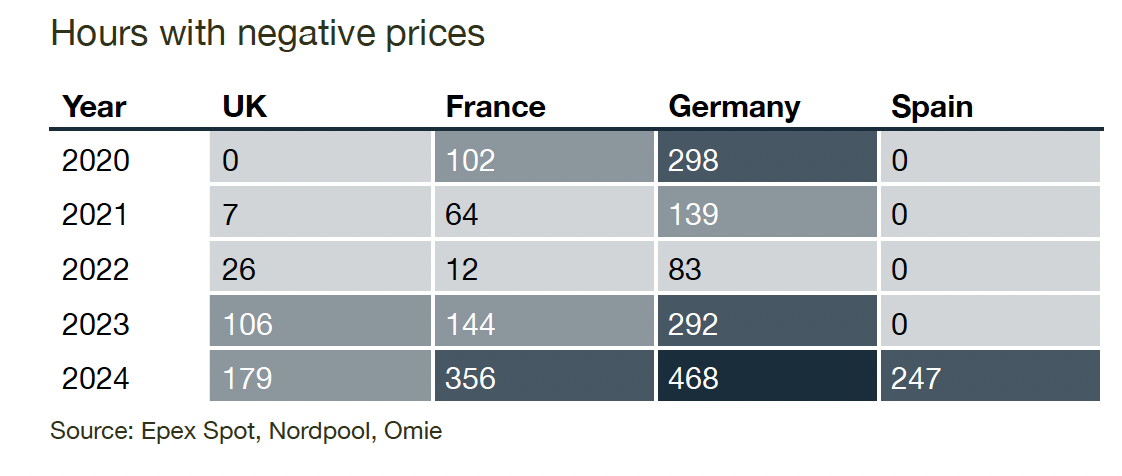

Negative Power Pricing Across Europe

Europe’s Power Prices Increasingly Falling Below Zero

The trend is now clear. Europe is set to install 275GW of new wind power capacity over 2025-2030. The EU has a target of 425GW by the end of the decade. Negative power pricing is impacting market sentiment and PPA risks. PPA markets continue to lag gas markets in moves higher. Risks for PPA generators persist through to 2030.

Jamie Banks

PPA Manager at New Stream“If you look at the German market at the start of this year, the wind performance was staggering. 40GW is just crazy when you consider how weak relative demand is. Negative prices are going to be a growing trend in Europe as we develop more renewable capacity. Here in the UK, we have also seen recent negative system pricing reflecting the supply-demand balance.”

Europe Gas Flows Adjusted After Ukraine Transit Ends

Central European gas flows had to adapt as Russian supplies through Ukraine stopped on January 1st.

Central European gas flows had to adapt as Russian supplies through Ukraine stopped on January 1st.

- Austria: Had received gas through Slovakia even though its contracted molecules from Gazprom stopped in November. Austrian Grid Management nominated increased imports from Germany.

- Slovakia: Eustream data showed nominations for daily flows to Slovakia from Hungary were at their highest of the year so far.

- Czech Republic: Traders have also switched to taking gas from the German network.

Market Volatility and Pay Impact

- The cessation of Russian gas supplies has contributed to increased volatility in energy markets, affecting both gas and power prices. This volatility places more importance on timing for fixing PPA rates and hedging gas positions.

Strategic Recommendations:

- PPA Market: We recommend locking in PPAs to 2027, capitalising on current market strength.

- Green Gas: We suggest layering hedges, as the market remains volatile.

- Gas Hedging: For clients exposed to gas prices, it’s essential to use a layered approach to mitigate risks and take advantage of price spikes

Conclusion: Key Actions for Clients

To manage risks and optimise pay outcomes, we recommend the following:

PPA Contracts: Act quickly to lock in PPAs through to 2027, taking advantage of current market strength.

Green Gas Hedges: Layer hedges and monitor market movements closely, as the outlook remains volatile.

Strategic Positioning: Clients should evaluate their exposure and prepare for potential price increases, especially if the cold snap persists or further gas supply disruptions occur.