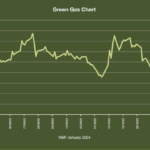

PPA and Green Gas markets continue to look for direction after last week’s move down.

- Front-end NBP gas has recovered some losses as the focus turns to “heating season“. Some forecasts of below-normal temperatures across North West Europe.

- Some cold weather will increase wind, which will aid renewable performance and supply.

Gas

- On the gas side, we are still waiting for reports on the talks between Russia and Ukraine regarding the last contracted transit supplies, which expire in December. It seems unlikely that we will find a resolution, but let’s see.

- Looking at the broader commodity complex and the demand picture, Crude oil has hit a new year-low, and equity markets still look fragile.

- Demand in Europe remains weak. Recent data shows that the UK imported a record high of electricity between April and June, with French nuclear performance also contributing to this number.

- We have continued to take advantage of some compelling PPA price structures through 2026, which, in our opinion, still represent fantastic relative value.

Please let me know if you want to discuss any PPA or Green Gas fixing options.

- NBP and Dutch TTF benchmark gas pricing dropped to a six-week low in the afternoon trading session yesterday. This move effectively erased the gains we saw in the mid-August rally.

- Front-end gas prices were down close to 6% at one point.

- As we have discussed previously, weak demand and strong renewable power generation were seen as the main sentiment drivers.

- We also obviously have “full” European gas storage.

- PPA and renewable power markets followed the gas lower.

- We are now back in a position of needing some market “event” to move things higher again. However, we expect price volatility to continue, particularly since some of yesterday’s move was attributed to “algorithmic traders” unwinding positions on the back of “overbought” technical signals.

- This morning, the NBP was up around 0.5% in early trade.

Fran Reay

Analyst

If you have any questions, please call the desk. Thank you