Why European Gas Storage Has Become a Key Price Driver for Green Gas and PPA

“Since the invasion of Ukraine triggered a dramatic downturn in Russian pipeline supply, European gas storage inventories have been a closely watched metric for traders and generators. Historically, we would have seen some pipeline gas flexibility from the East. However, that is no longer the case, and storage is now an increasingly important buffer against supply shocks and price spikes.”

Charles Ward Head of Renewables at New Stream

Current Gas Storage Overview

- Europe uses gas storage to balance the market.

- Gas is withdrawn from inventories in the winter and injected in the summer.

- Europe needs gas storage to meet winter demand.

- Average winter consumption has doubled as heating is turned up.

- Gas held in storage covers about 30% of the EU’s daily needs during the winter.

- Germany leads EU gas storage capacity.

- The EU typically has enough to meet a third of its annual consumption.

Market Backdrop

- Weather conditions have seen Europe burn through its gas reserves more quickly over the winter.

- Industrial gas demand remains relatively low.

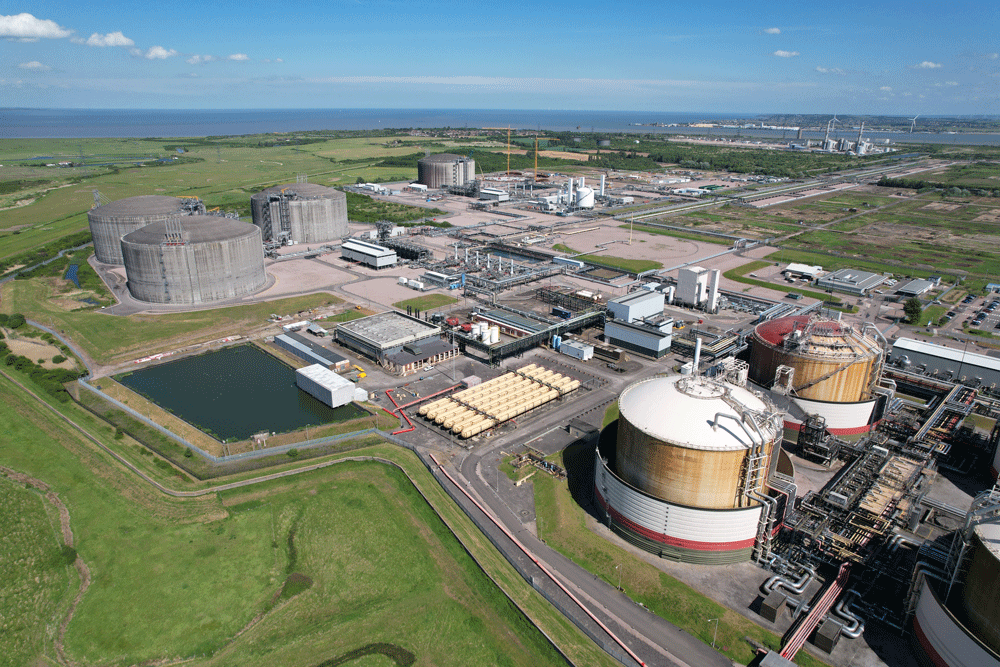

- LNG Imports have stepped up to fill some of the gap.

- Focus on storage “injection season”.

- Summer markets are now the battleground for gas traders.

- Seasonal price spreads flipped to make it uneconomic to refill inventories over the summer.

Where are Current Gas Storage Inventories

- 43% full as of last week.

- Well below the 65% seen a year prior.

- This is the lowest level for this time of year since 2022.

Geopolitics

Jamie Banks

PPA Manager at New Stream“If a peace deal is reached between Russia and Ukraine, then theoretically, we could see a return to the gas transit via that route into Europe. Whether the EU would revert to importing Russian pipeline gas remains to be seen, and obviously, the Nord Stream pipeline was sabotaged. Our current view is that the EU bloc would unlikely wish to relinquish control of its energy security back to Moscow. However, anything is possible with Trump pushing both parties so hard.”

Nord Stream: What’s known about the mystery pipeline explosions?

In September 2022, explosions damaged the Nord Stream pipelines, leading to significant gas leaks and geopolitical tensions. Investigations confirmed sabotage, but no culprit has been officially identified.

Read More Reuters – Nord Stream Pipeline Explosion

So What Has Changed?

- The energy crisis sparked by Russia’s invasion of Ukraine saw the EU introduce legally binding targets for gas storage.

- The aim of this was to ensure the security of supply.

- Inventories must be at least 90% complete by Nov. 1, and interim milestones must be met in February, May, July, and September.

- These “intermediate targets” vary by member state, depending on their storage capacity and consumption levels.

- Some countries fell short of their respective targets this month.

- The European Commission is due to propose extending the gas storage targets until 2027.

Why are there concerns about Europe’s gas storage levels in 2025?

- The EU’s gas storage inventories quickly depleted over the 2024-25 “heating season”.

- Colder weather this year and more windless days increased demand for gas.

- The EU’s gas storage levels in February was below both 2024 levels and the five-year rolling average

What does this mean for Green Gas and PPA Pricing?

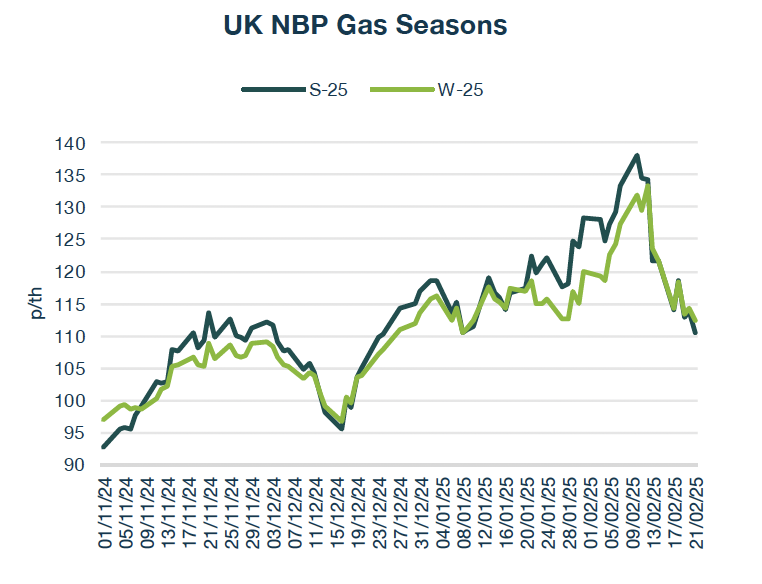

Green Gas markets have found support from strength in underlying NBP and TTF gas markets, but price volatility remains high. Underlying fundamentals remain tight for gas, but there is considerable uncertainty around geopolitics and what the EU will do regarding storage targets.

Gas markets continue to drive power and PPA pricing, but these markets have tended to lag the gas move higher. We have been flagging recent market strength as a potential fixing opportunity for those PPA generators looking for budget certainty and downside price risk protection.